Explain the Difference Between a Direct and Indirect Tax

Indirect tax is tax collected by intermediaries for eg. Direct tax is imposed directly on the taxpayer and is paid by the taxpayer directly to the government.

Difference Between Direct And Indirect Taxes Introduction To Indire

Economical and lower cost mechanism.

. Indirect taxes being wrapped up with retail prices are more efficient than direct taxes and more difficult to evade. Explain the difference between a direct tax and an indirect tax. A Indirect tax is imposed on one person but paid by the other.

Examples of indirect taxes include liquor fuel. Individuals firms companies pay direct taxes. C Impact and incidence are on the same person ie the tax payer is also tax bearer.

It covers an entityindividual. Unlike a direct tax indirect taxes do. The tax is collected by the supplier and paid to the government.

These taxes cannot be shifted to any other person or group. A A direct tax is paid by a person on whom it is legally imposed. Whether checks are written to be.

A bit like a middleman. A major difference between direct and indirect tax is the fact that while direct tax is directly paid to the government there is generally an intermediary for collecting indirect taxes from the end-consumer. If the income of the assessee increases the burden of the tax would reduce.

This means that direct tax increases with the amount that is available for taxation while indirect tax reduces the amount that is available for taxation. It is applicable to taxpayer. These taxes cannot be shifted to any other person or group.

The burden of tax cannot be shifted in case of direct taxes while burden can be shifted for indirect taxes. It is to be paid by End-consumers. A person possessing a certain amount and property is bound to pay tax according to rules defined by the law.

As of now we have discussed the basics of the two types of taxes now we will move forward to understand the difference between direct tax and indirect tax. The consumer essentially pays the tax by paying more for a product since the tax is added on top of the price. A direct tax is one that the taxpayer pays directly to the government.

Whereas indirect tax is ultimately paid for by the end-consumer of goods and services. The incidence and impact of the tax is on different persons. It is imposed on income and profits.

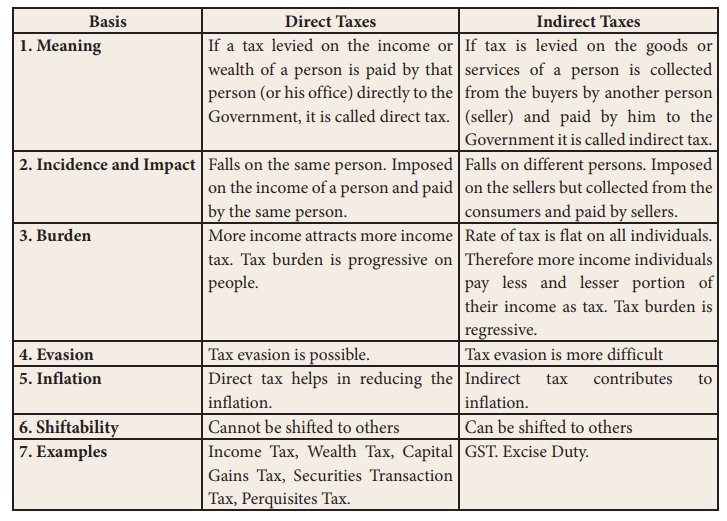

It is then the responsibility of the intermediary to pass on the received tax to the government. Key Differences Between Direct Tax and Indirect Tax. The major differences between direct tax and indirect tax are as follows.

The body that collects the tax will then remit it to the government. A direct tax is one that the taxpayer pays directly to the government. Indirect taxes on the other hand are taxes that can be transferred to another entity.

Direct tax is a progressive tax. Taxes can be either direct or indirect. It cannot be transferred.

The main differences between direct taxes and indirect taxes are given in table. The certainty of tax to be paid. Difference between Direct taxation and Indirect taxation.

Cost of collection is also less in case of direct taxes which is pretty high in direct taxes. There are basically two types of taxes direct and indirect taxes. Retailers from the ultimate taxpayer ie.

Collection of direct taxes is generally economical. Direct Tax refers to the tax which is paid directly to the government by the person on whom it is imposed. If tax is levied on the goods or services of a.

The following are the differences between the two. One of the major difference between direct and indirect tax is that direct tax is progressive while the indirect tax is retrogressive. An indirect tax is one that can be passed on-or shifted-to another person or group by the person or business that owes it.

It is the tax on incomeprofits. It is to be paid by Individuals and businesses organizations. Direct tax is levied and paid for by individuals Hindu undivided Families HUF firms companies etc.

Key differences between Direct and Indirect Tax are. The taxpayer is certain as to how much tax is to be paid as the tax rates are decided in advance. Taxes can be either direct or indirect.

The difference therefore between direct and indirect taxes is that in the case of direct taxes the individual pays the tax directly to the government but when it comes to indirect taxes the individual pays the tax to someone else. It is burden on individual. The difference therefore between direct and indirect taxes is that in the case of direct taxes the individual pays the tax directly to the government but when it comes to indirect taxes the individual pays the tax to someone else who then pays it to the government.

An indirect tax is one that can be passed on-or shifted-to another person or group by the person or business that owes it. The same implies for the government where it can estimate the tax revenue from direct taxes. Indirect taxes can be defined as taxation on an individual or entity which is ultimately paid for by another person.

It cant be transferred to others. Unlike direct taxes where documents need to be accomplished and filing is required indirect taxes are paid the moment a consumer buys a product. The difference between a direct tax is one that must be paid directly to the government by the person on whom it is imposed and indirect tax is one first paid by one person but then passed on to another.

Indirect tax however is a regressive tax. If the income of the taxpayer increases the tax liability would also increase. Direct Taxes Vs Indirect Taxes.

The amount of tax to pay depends on the ability of the taxpayer. People have therefore developed a concept that. Direct taxes apply to a persons property assets and money.

If a tax levied on the income or wealth of a person is paid by that person or his office directly to the Government it is called direct tax. Businesses may recover the cost of the. B Sales tax excise duty service tax are examples of indirect tax.

Direct taxes refer to taxes that are filed and paid by an individual directly to the government. On the other hand Indirect. Then there are no exemptions in case of indirect taxes whereas there are many kinds of exemptions in direct taxes.

It is imposed on all goods and services. Direct taxes are the taxes that a person submits directly to the government without including any third person. Also they can be avoided by not buying the goods.

The incidence and impact of the tax is on the same person.

What Is The Difference Between Direct And Indirect Tax Quora

Differences Between Direct Taxes And Indirect Taxes

What Is The Difference Between Direct And Indirect Tax Quora

What Is The Difference Between Direct And Indirect Tax Quora

Comments

Post a Comment